NVIDIA CEO's Comments Shake Quantum Stocks: Analysis and Investor Guidance

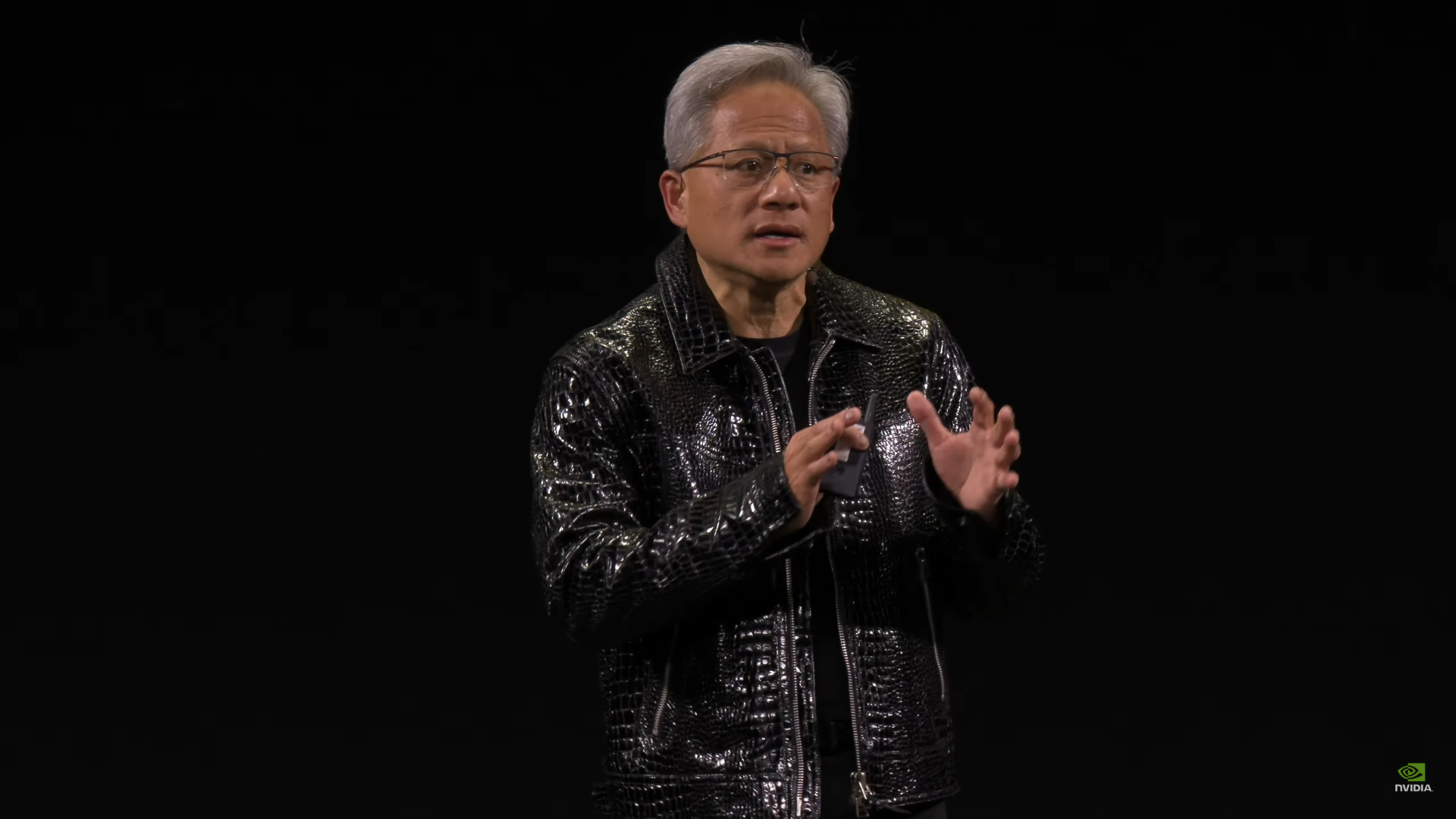

During an industry keynote at the CES 2025 NVIDIA CEO Jensen Huang made comments about the quantum computing sector that sent shockwaves through the market. Huang expressed skepticism about the near-term commercial viability of quantum computing, stating:

"While quantum computing has immense potential for scientific discovery, the path to widespread industrial application is far longer and more uncertain than what many speculate. The hardware challenges alone make scalable solutions a decade away, if not more."

"While quantum computing has immense potential for scientific discovery, the path to widespread industrial application is far longer and more uncertain than what many speculate. The hardware challenges alone make scalable solutions a decade away, if not more."

This statement directly countered the prevailing optimism surrounding quantum technologies and prompted a market-wide reevaluation of quantum computing companies.

Reasons behind lagging quantum technology

Huang’s remarks were contextualized within NVIDIA’s strategy to double down on artificial intelligence (AI) and high-performance classical computing. By drawing attention to the limitations of quantum computing’s scalability, Huang emphasized the ongoing relevance and dominance of NVIDIA’s GPU technologies. Analysts speculate his comments may have been a strategic move to reinforce confidence in NVIDIA’s core markets while downplaying emerging competition.

8B of Quantum stocks market cap got erased immediatelly

Leading quantum computing companies saw significant declines following Huang’s statements. Here’s a detailed snapshot of the affected stocks:

- IonQ (IONQ):

Fall: -22% to close at $12.45 (from $15.95).

Historical Performance: IonQ shares had rallied over 120% year-to-date before this downturn, driven by optimistic forecasts and government contracts. - Rigetti Computing (RGTI):

Fall: -18% to $0.89 (from $1.08).

Historical Performance: Rigetti’s stock surged 85% in the last six months on announcements of technical advancements and strategic partnerships. - D-Wave Quantum (QBTS):

Fall: -15% to $1.35 (from $1.59).

Historical Performance: D-Wave’s stock price had climbed 90% since the start of 2024, buoyed by its claims of quantum supremacy in niche use cases. - Alphabet (GOOGL) (quantum research arm impact):

Fall: -3% to $135.22 (from $139.50).

Historical Performance: Although primarily driven by its core business, Alphabet has invested heavily in quantum research, making it a secondary casualty.

Why Were Quantum Stocks Rallying?

Quantum computing stocks had enjoyed a robust rally in recent years due to:

- Technological Milestones: Companies claimed breakthroughs like achieving quantum supremacy and scaling qubits.

- Government Support: Increased funding for quantum research from the U.S., EU, and China boosted investor confidence.

- Hype Cycle: Market speculation often outpaced actual progress, inflating valuations.

- AI Complementarity: Optimism about quantum computing accelerating AI and machine learning applications.

Insights for Value Investors

Huang’s comments have catalyzed a reality check for quantum computing stocks, offering both risks and opportunities for value investors.

How to Act:

- Reassess Timelines: Quantum computing’s potential remains significant, but timelines for monetization are extended. Investors should focus on companies with sustainable cash flows or diversified business models.

- Monitor Technical Progress: Keep an eye on tangible milestones like error correction advancements and scalable qubit counts.

- Diversify: Hedge bets on quantum by investing in adjacent technologies like AI and classical high-performance computing.

- Look for Strategic Partnerships: Companies collaborating with giants like NVIDIA, IBM, or Google are better positioned to weather skepticism.

What to Watch For:

- Updated Guidance: Track how affected companies respond to Huang’s comments in earnings calls or investor presentations.

- Government Funding Trends: Continued support from governments can stabilize long-term prospects.

- Competitor Positioning: How NVIDIA’s direct competitors in AI and quantum respond could further shape market sentiment.

Conclusion

While Huang’s comments cast a shadow on quantum computing stocks, they also provide a crucial reminder of the speculative risks in nascent technologies. By adopting a disciplined, long-term approach, value investors can navigate this volatility and position themselves for potential future gains in the quantum space.